X In App Support

- Home

- X In App Support

"Reducing customer calls (in app support)"

A UX Design–turned–research company project for Bankwest.

PROJECT OVERVIEW

The brief: To reduce customer call centre calls through uplifting in app support.

The set up: Working on this initiative alongside various other initiatives with multiple cross functional squads.

The process: Research, synthesis, design and iteration.

Key tools: Figma, Askable, Teams.

Key methods:

● Current state analysis (tree node diagram).

● Competitor and comparator analysis.

● Service Design Blueprint.

● User interviews.

● Analytics analysis.

● Collaborating with multiple teams at the bank.

● UI Design, wireframing and prototyping.

My role: Owned UX Research, synthesis, Design. Engaged and collaborated with multiple squads across the bank with intersecting work.

The problem: The call centre receives 25 000 calls per month but Bankwest only has he resources to take 18 000 calls per month, resulting in a 50% abandon rate on these calls, low net promoter score (NPS), colleague burn out and frustrated customers. Customers cannot self serve and get the help they need in app to resolve their issues, without having to call the bank.

The solution: We made it easier for customers to self serve and find the help they need in app for their most pressing issues, without needing to call the bank. We did this by digitising the dispute transaction process, providing a dedicated help page and prioritising the message us feature.

RESEARCH

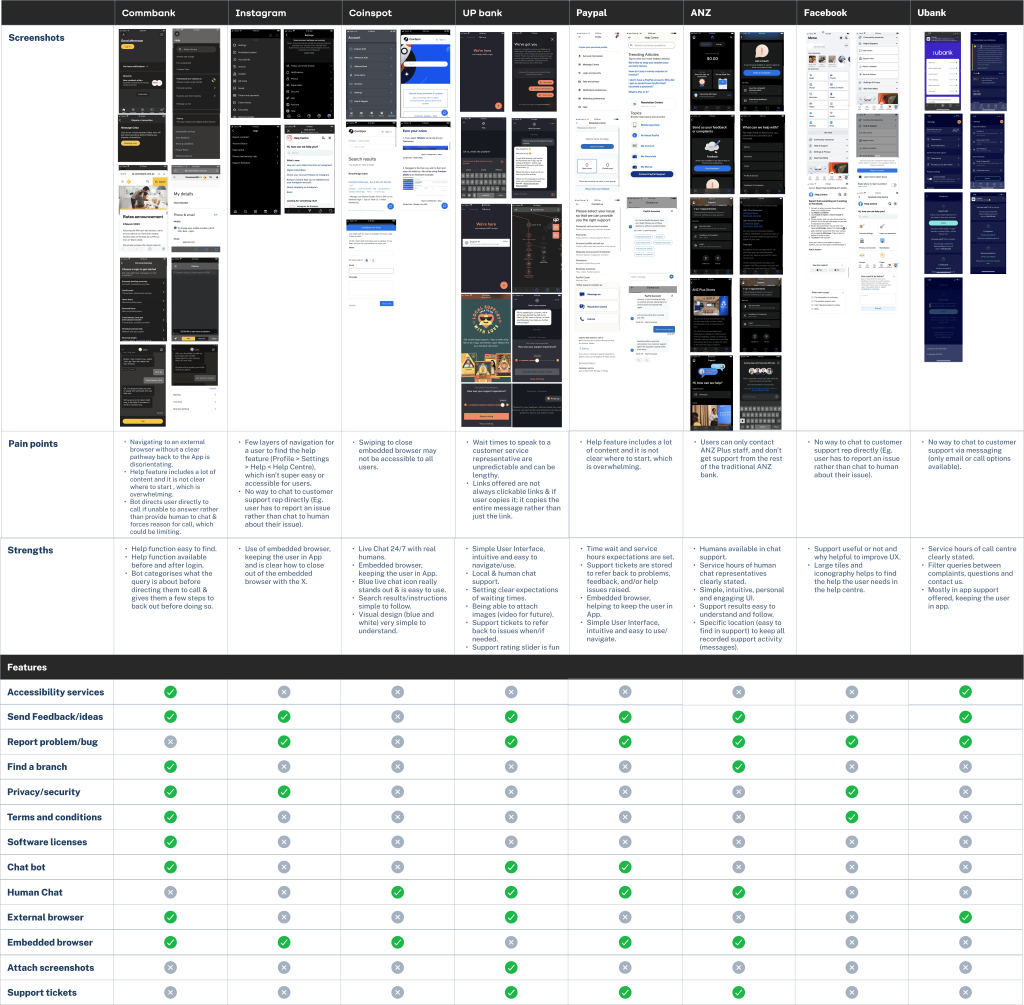

We compared a range of in app support experiences.

Extensive competitive and comparator analysis helped us gain insights into how other apps handle in-app support. We identified some clear opportunities for improvement, regarding our chat feature, FAQs and the overall information architecture (IA) of help.

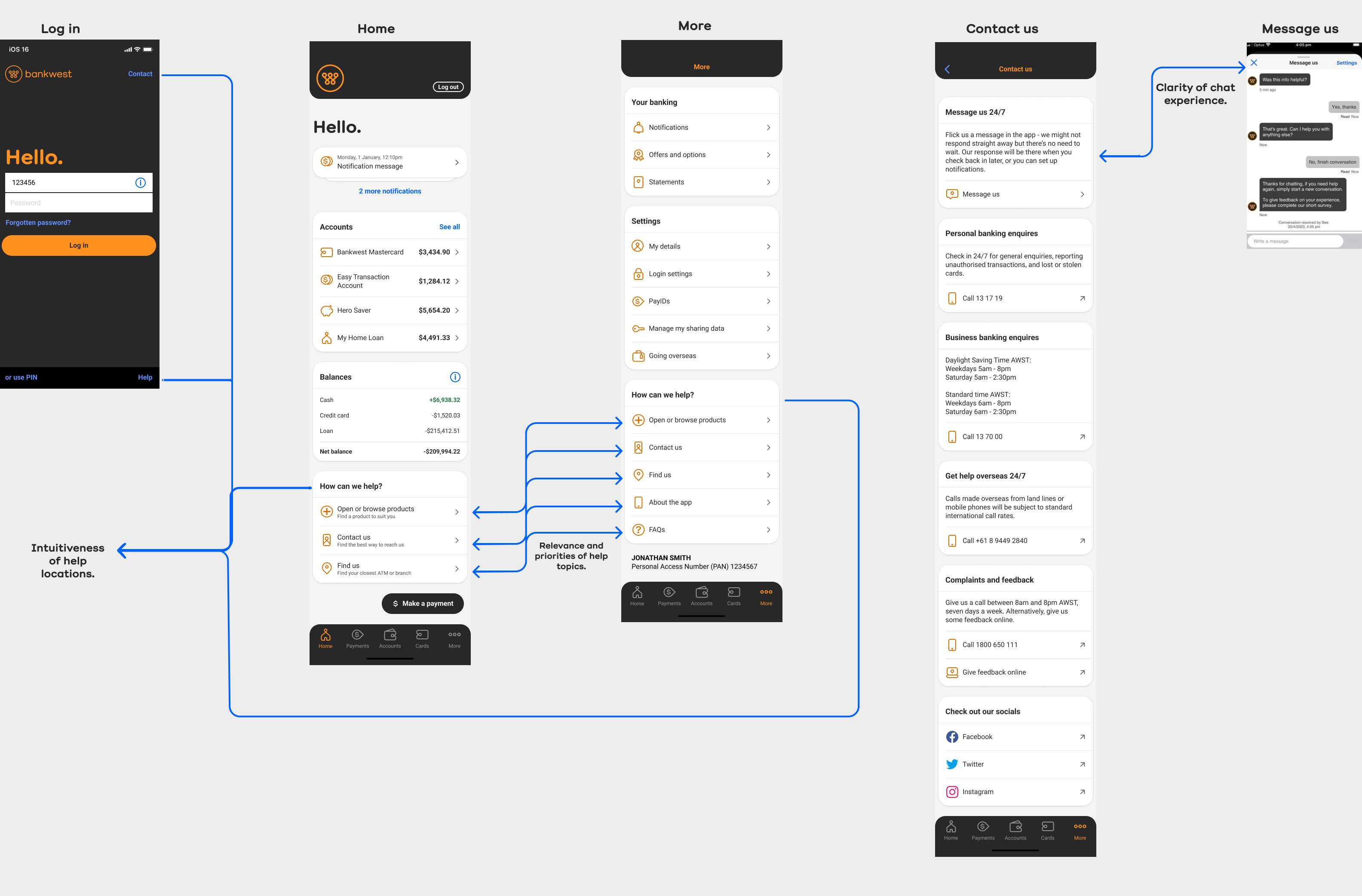

Current state analysis.

A detailed tree node diagram of the current state of the bank’s in app support helped us to analyse the experience at a closer level. Some clear pain points were already evident and some some key opportunities to further explore were:

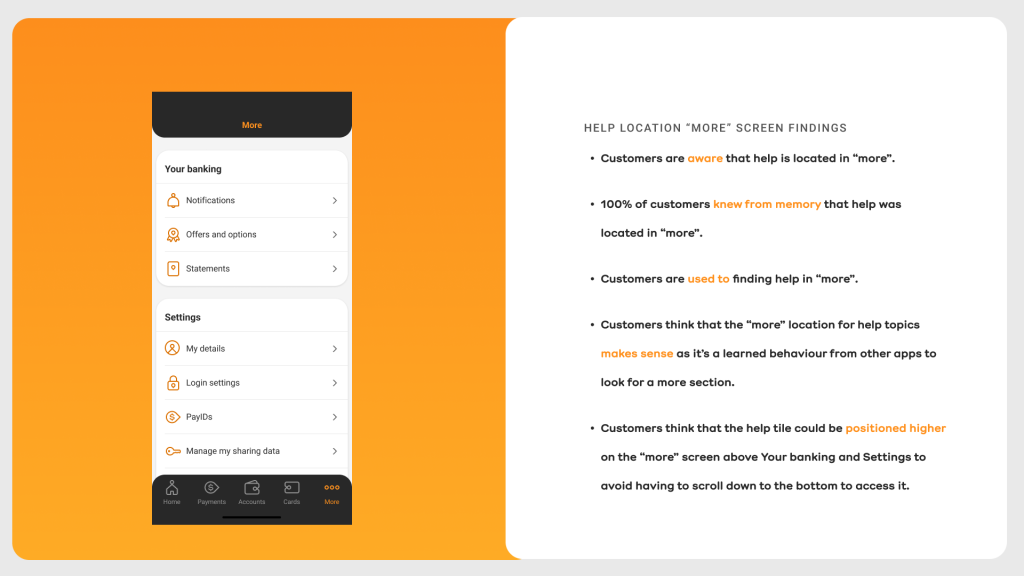

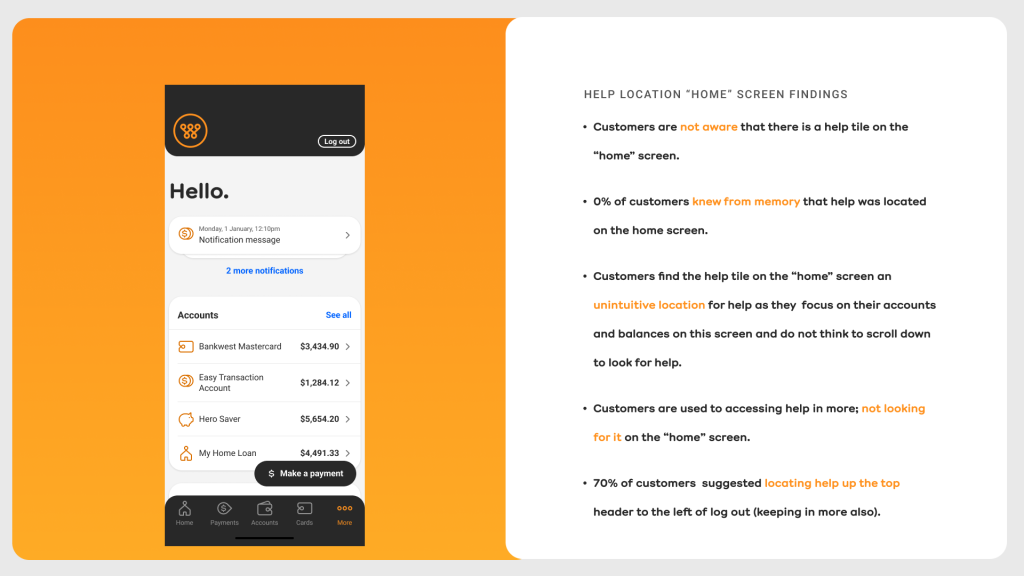

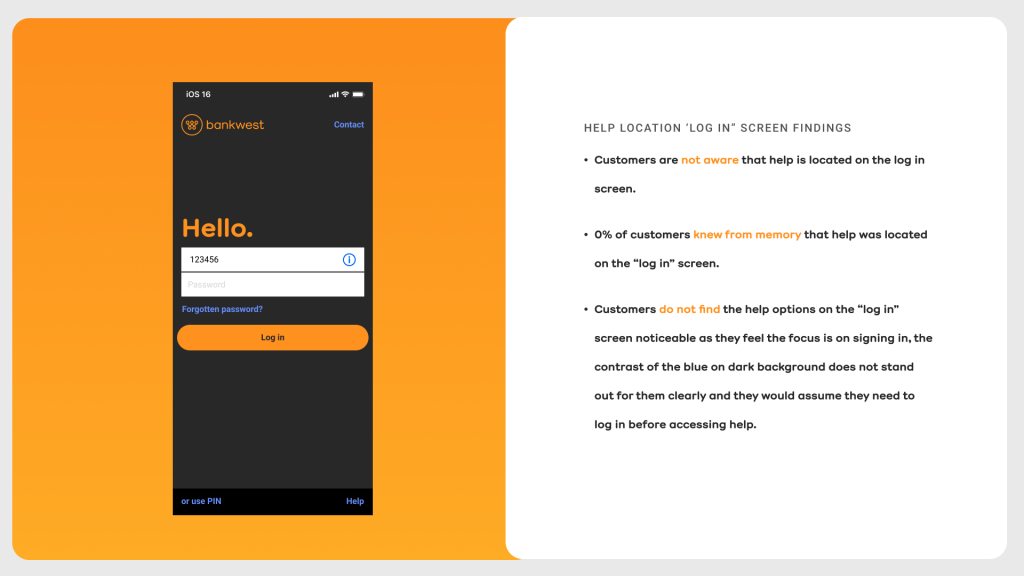

● Whether the help locations were intuitive for users to find?

● How relevant and of how high priority help topics were to users?

● Whether the chat experience made the most sense to users and was it meeting their expectations?

We consulted with our app users.

We did 10 target user interviews, covering 5 tasks, with bankwest app customers in order to learn:

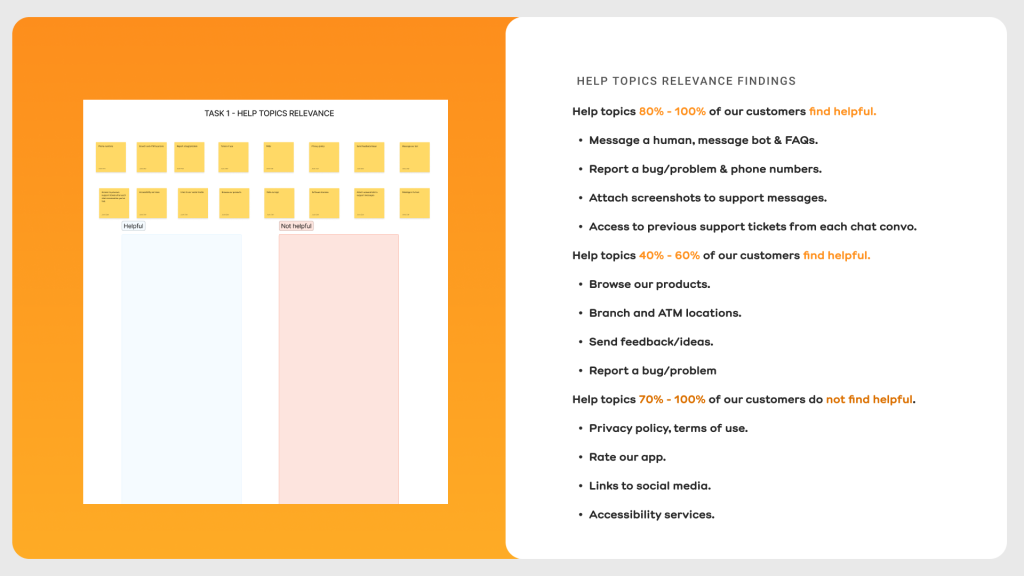

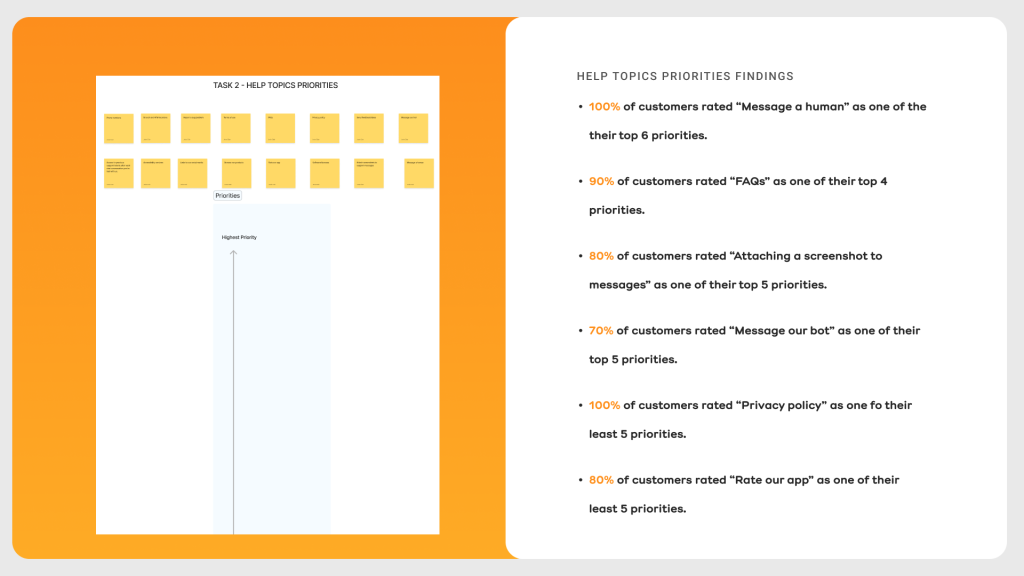

● Which help topics customers find helpful or not helpful and of highest to lowest priority and why.

● Customer pain points of finding help in app and expectations of where help would be the most intuitive and easy to find and why.

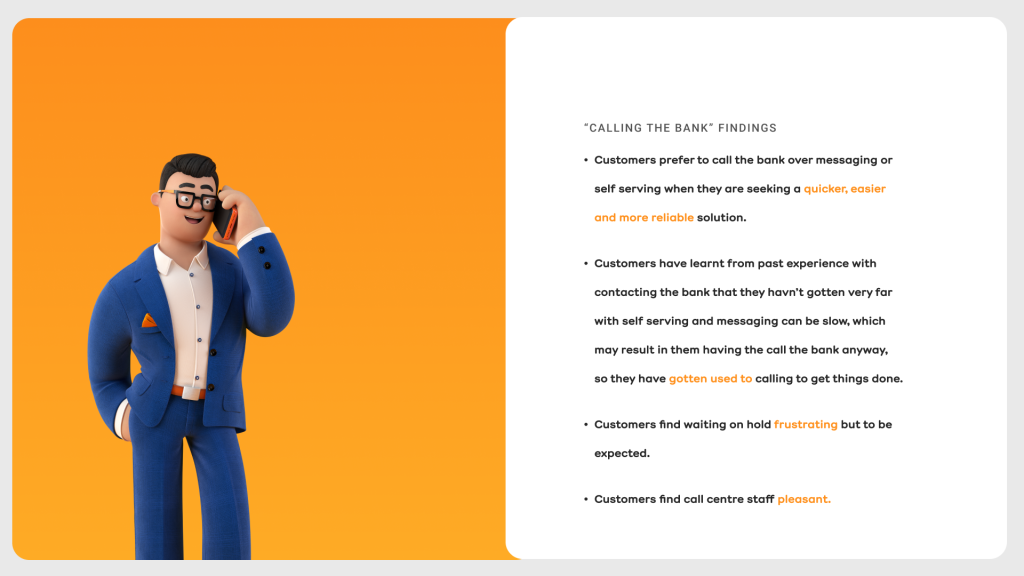

● Why users call us rather than message us, how long they try to resolve issues before calling us, what’s been their processes to solve issues and how have their experiences been.

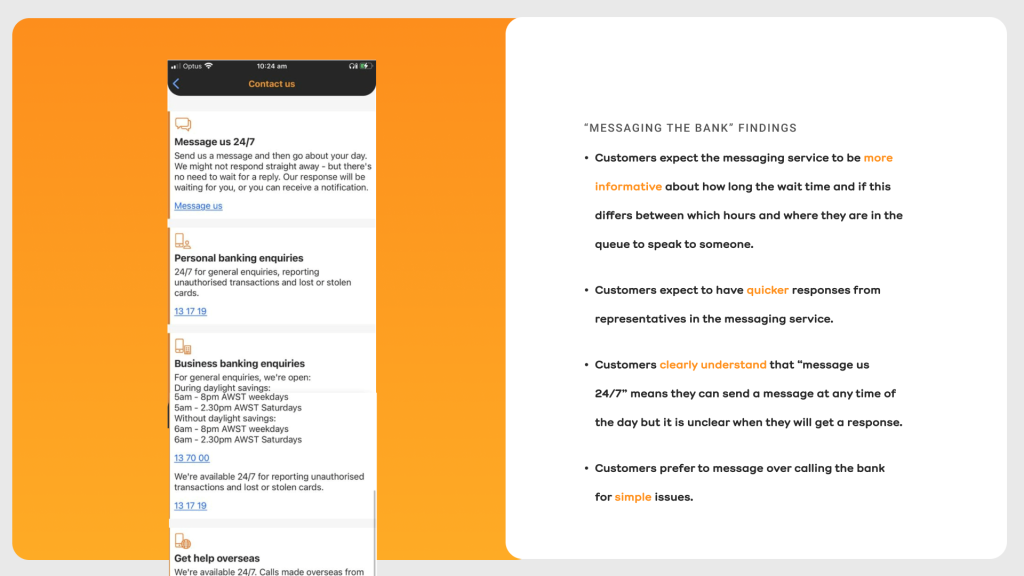

● Customer pain points, experiences and preferences with messaging the bank and what their expectations are of this experience.

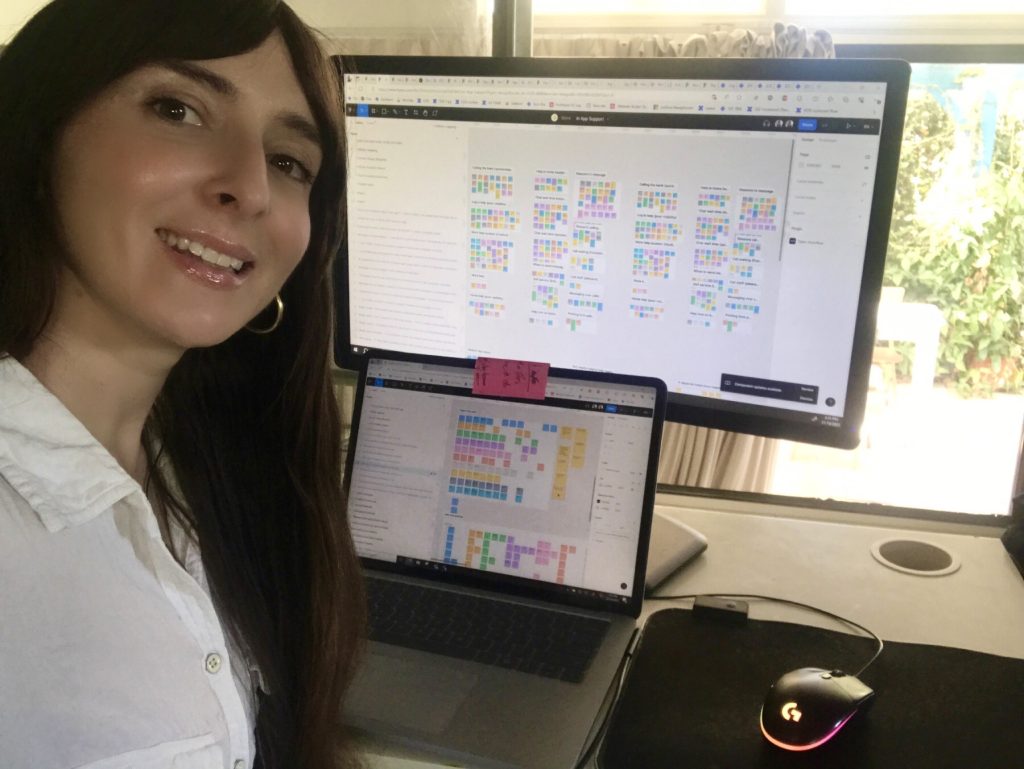

There were some clear themes that emerged.

Digital affinity mapping enabled us to synthesise the feedback from the interviews and all that we’ve learnt from the UX research thus far. Some clear themes emerged in this process about users’ expectations and pain points regarding the bank’s in app support experience.

These were our findings and insights.

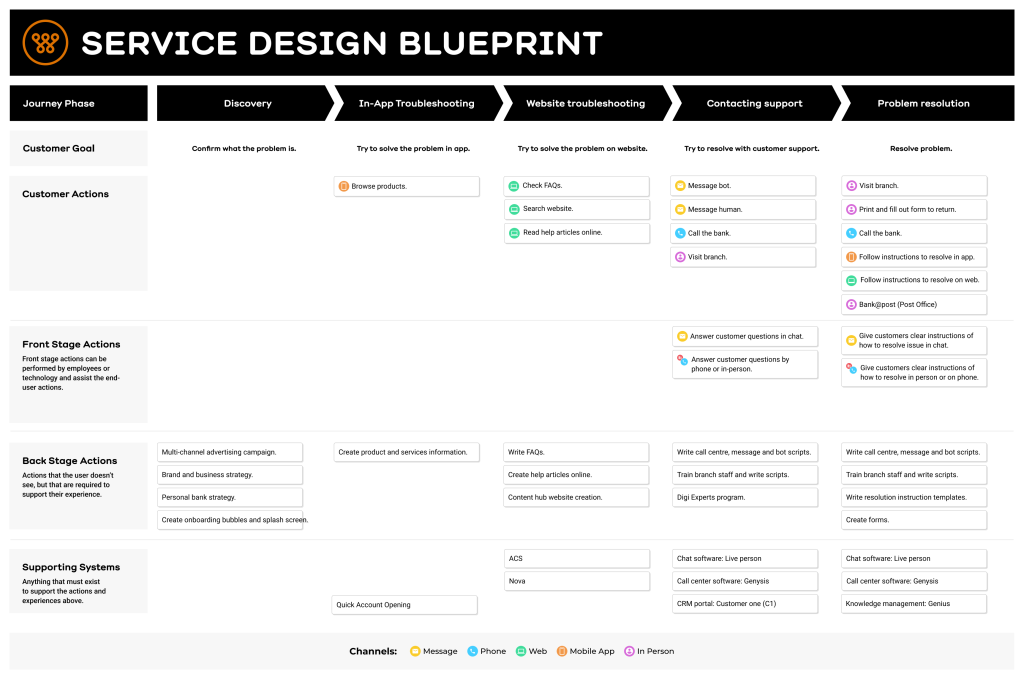

Service Design Blueprint

Creating a service design blueprint for the customer journey of problem resolution with the bank enabled us to visualise what’s going on in the organisation and understand some of the the implications of potential process changes.

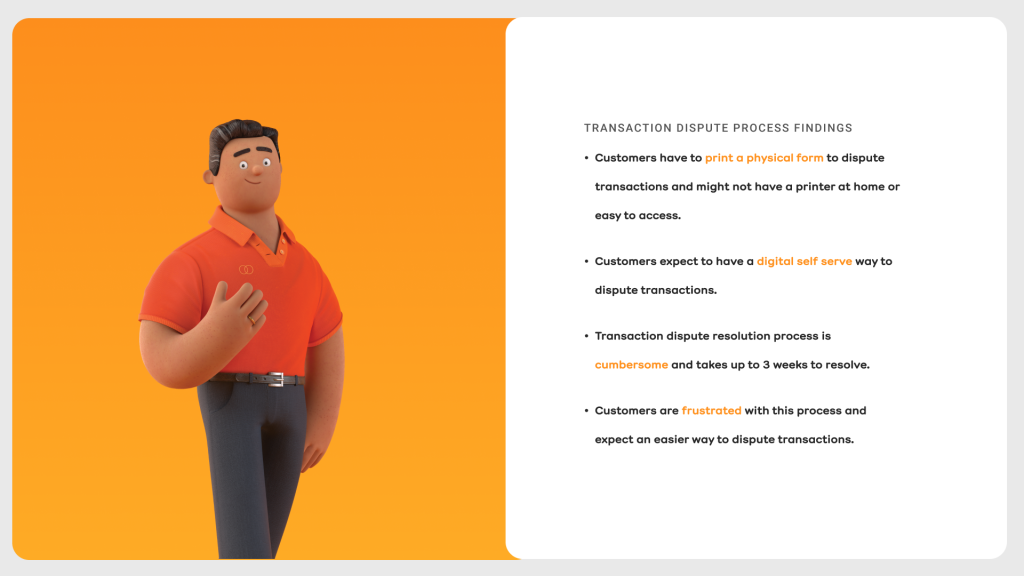

In the problem resolution phase the customer may have to visit a branch, use bank@post at a post office and/or print and fill out a physical form, which are all ‘in person’ customer actions, which we want to minimise to help our customers self serve digitally as much as possible and to strive to be digital disrupters in the industry.

Business vision = digital disrupters.

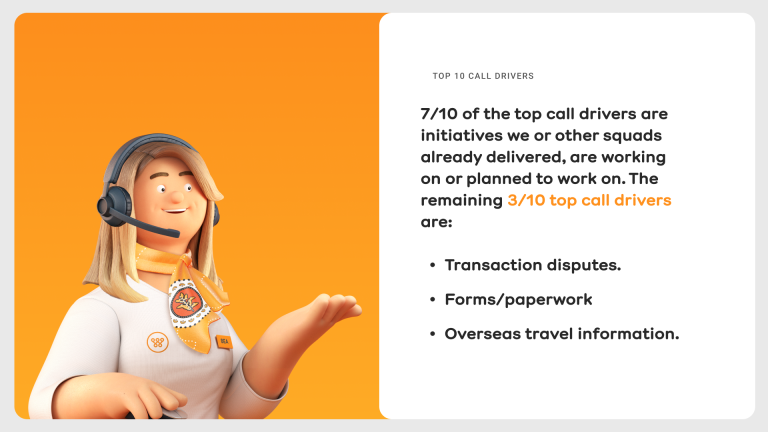

Quantitative data re-enforced our qualitative data insights.

There were multiple data sources from 400+ customers (margin of error 4.7%) that we drew from including:

● Surveys and adobe analytics.

● Reviews and complaints.

● Call centre and branches.

● Website search and help pages.

● Digital conversations (messaging).

Stakeholder engagement and collaboration was key.

Aside from valuable collaboration with the self service first, website, digital conversations and daisy squads I also reached out to the customer insights manager at the bank to take him through my research thus far to see if he had any relevant insights. The quantitative data he synthesised from a 442+ customer survey aiming to optimise digital engagement validated that completing transaction disputes in-app was highly sort after by our customers.

SOLUTIONS

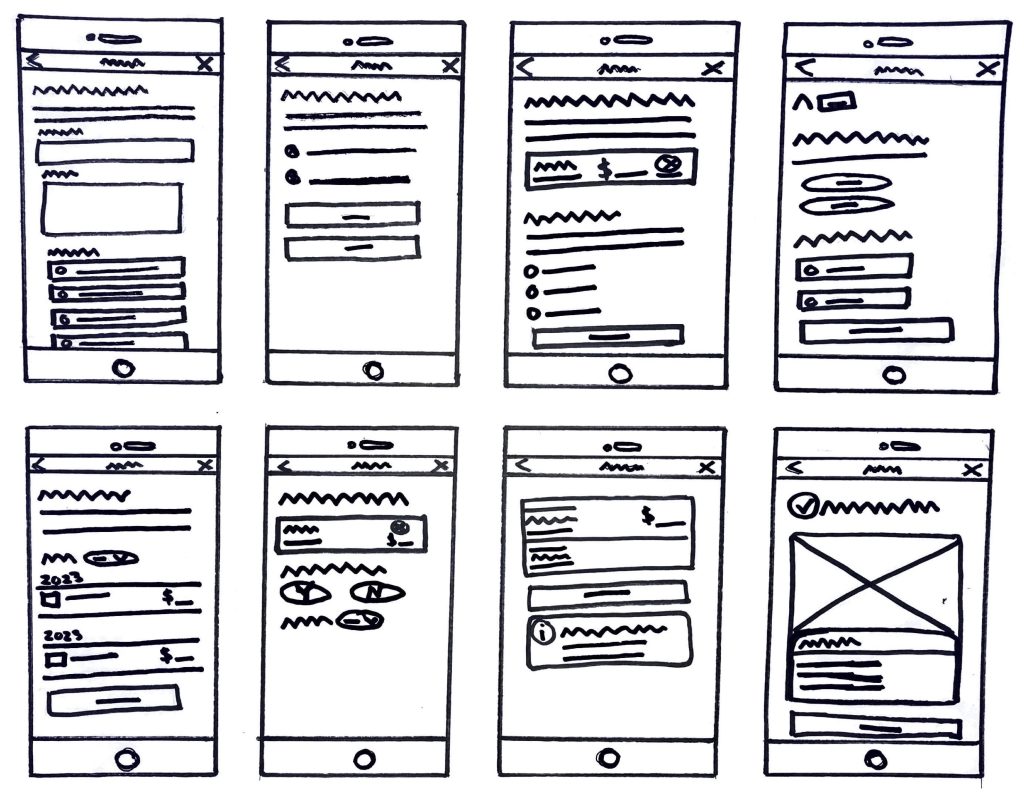

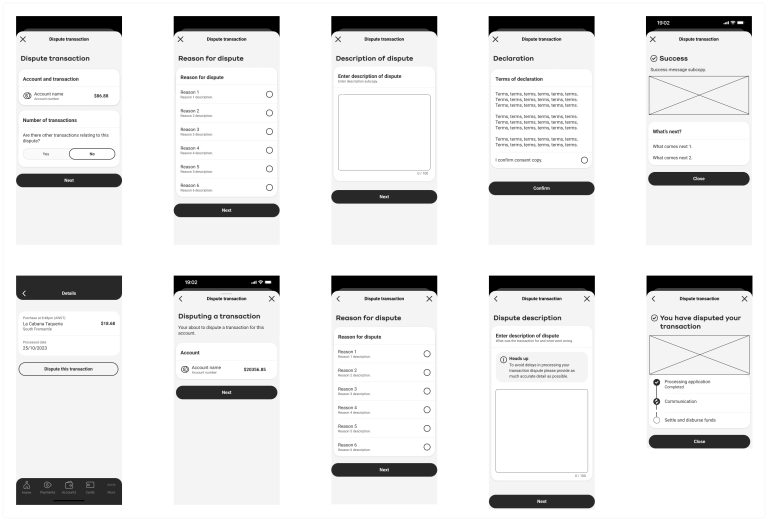

Sketching and wireframing the self serve transaction dispute app flow.

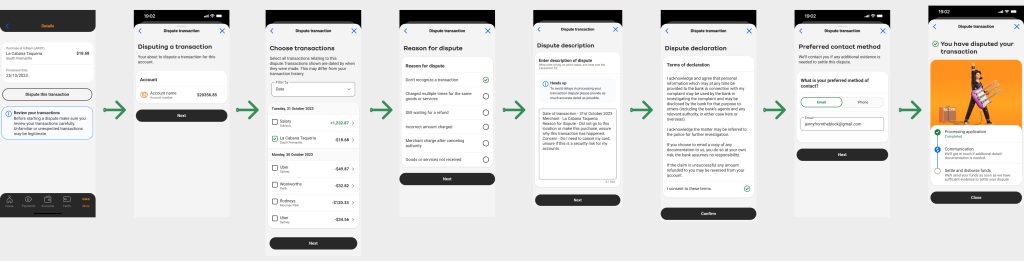

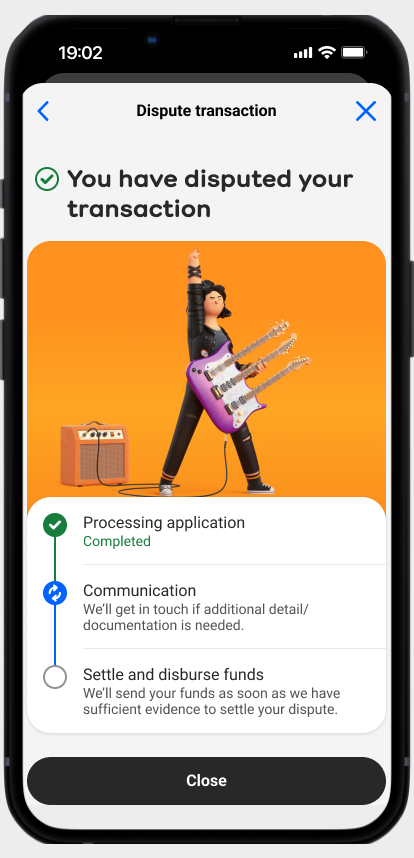

On brand "simple and easy" UI Design solutions.

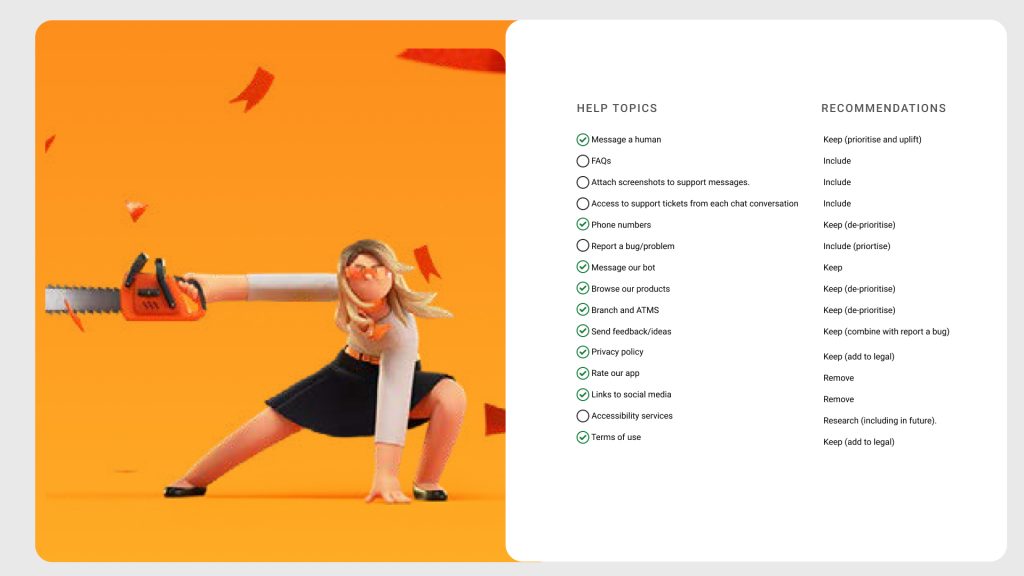

Further recommendations to support customers in app.

Re-route, but not the end.

We felt very enthusiastic about continuing to work on this in app support initiative with so much great research driving our solutions. However, the bank had a re-structure and our squad was given a different initiative to work on from our new leaders. “Uplifting chat” and “Self serve transaction dispute” initiatives were both given to different squads at the bank. Therefore, I handed over the relevant work I’d done that would be of assistance and continued to support the squads as needed.