"Removing the biggest customer pain point of password reset"

The brief: Reduce Bankwest password reset calls by 20%.

The problem: Password reset issues, specifically challenges with entering card numbers and PINs, are the biggest driver of Bankwest’s call volume. The call center receives 25,000 monthly calls but can only handle 18,000, leading to:

● A 50% call abandonment rate.

● Low Net Promoter Score (NPS) due to customer frustration.

● Increased colleague burnout from excessive call demand.

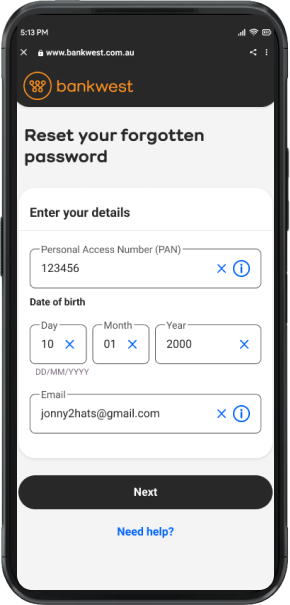

The solution: Replaced card number and PIN inputs with intuitive email and date of birth fields, improving usability and reducing errors. Key improvements:

✅ Reduced steps/screens for a streamlined experience.

✅ Applied Bankwest’s latest design system for consistency.

✅ Designed a custom date of birth input to minimize errors and enhance usability.

The process: Mobile and website design, including synthesis and iteration.

My role: Led UX Design while collaborating with POs, BAs, copywriters, accessibility experts, and developers.

Key tools: Figma, askable, JIRA, confluence and teams.

Key methods:

● Current state analysis.

● Competitor analysis.

● User interviews.

● UI design.

● Prototyping.

Delivered: Drop 1 and Drop 2 UI designs for app, desktop and in app Browser, including detailed error states, dialogs and a custom component, with DEV notes/edge cases.

A little bit of background of our squad

In 2022 Bankwest closed 11 branches in 1 month on the east coast of Australia as these branches were high cost/low margin branches. That cost was re-directed to start the Self Service First (SSF) squad, which costs the bank $1.5 million per year to have. SSF being a new squad with high visibility, with many important stakeholders involved, we had a lot of pressure on us to deliver and prove ourselves at the bank.

Our vision of the outcomes

● Reduce password reset calls by 20%.

● Reduce call waiting times for customers.

● Reduce the abandon rate on calls.

● Increase our Net Promoter Score (NPS).

● Reduce colleague burn out.

● Reduce customer frustration.

Call centre data narrowed our focus

● 12 000 password reset calls were being made to the call centre each month.

● These calls were costing the bank $960 000 annually.

● Card number and PIN were driving 70% of the calls.

Exploring user preferences

We conducted 7 target user interviews with bankwest app customers to explore:

● Preferred personal details to use for password resets.

● Sentiment on biometric identification.

● Security understanding and concerns.

● Pain points during the password reset process.

Gaining deeper insights into user comfort and security

● Customers felt least comfortable providing their card number and PIN.

● They were most comfortable providing their phone number, email and customer ID.

● The majority have used or are using biometrics for identification.

● Biometrics were perceived as the most secure method (seen as nearly impossible to hack), followed by passwords, and PINs as the least secure.

● Common pain points included security questions, long wait times on calls, and restrictions on using previous passwords.

Streamlining the experience

● Replaced card number and PIN with DOB and email inputs for a more comfortable experience for our users.

● Aligned the UI with other squads’ screens and our design system for consistency.

● Designed a custom date of birth, 3 input component, for app and desktop to follow best UX standards and minimize user errors.

● Reduced task time by removing the large success screen and replacing it with a success toast on the login screen. This introduced a new design pattern to use toasts for smaller successes and large success screen for larger tasks.

● Merged two SMS step-up screens into one, simplifying the process.

Optimal native in-app experience

A native in-app password reset provides the most seamless experience for customers. It ensures a familiar and consistent interface and overall experience, strengthens trust in the process, and reduces friction—minimizing the chances of task abandonment or customers needing to call the bank.

De-scoping for MVP delivery

Due to security and time constraints, we couldn’t deliver the native in-app solution for our MVP. With pressure from our PO and key stakeholders for faster results, we de-scoped and delivered a single responsive solution for both desktop and mobile.

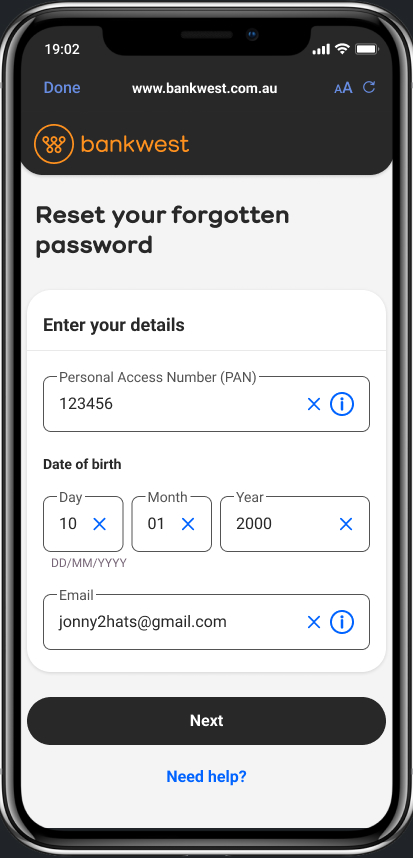

Navigating constraints with in-app browser

We knew directing customers out to an external browser from app would lead to poor experience. To maintain a high-quality user experience, I pushed stakeholders to implement an in-app browser solution. We also carefully considered its performance and design on both Android and iPhone devices.

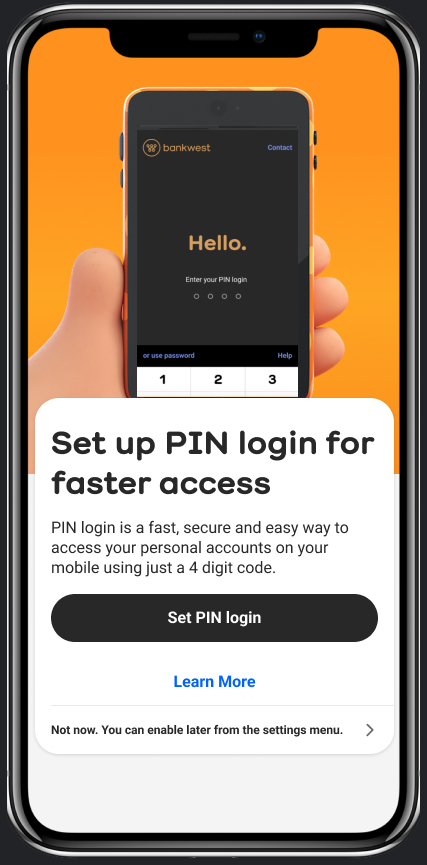

Mitigating repeat errors

I recommended a splash screen post-password reset, encouraging customers to set up PIN login. This prompt aimed to streamline future logins, reduce password reset frequency, and minimize the need for SMS step-ups. Additionally, PIN login is a prerequisite for enabling fingerprint or Face ID login, enhancing both security and user experience. By promoting PIN login, we set the foundation for a more secure, efficient customer journey.

What came next

● Conducted accessibility testing to ensure WCAG 2.1 Level AA compliance.

● Tracked data post-launch to measure the effectiveness of our MVP solution.

● Supported the squad in delivering Drop 2 changes, including button loading spinners and updating the in-app browser flow to direct users to the app login screen instead of internet banking.

Upon reflection...

Looking back, my UX improvements had a lasting effect on customer experience and operational efficiency. We successfully met our target of reducing password reset calls by 20%, which was directly tracked through our call categorisation system, addressing key business goals and made a strong impact as a new squad at the bank.